Asx 200 Yearly Growth / Investing Basics Australia S Largest Etf Explained In 5 Charts Morningstar Com Au : The asx 200 index is set to open mildly lower after a mixed wall street session despite rising iron ore prices.

Asx 200 Yearly Growth / Investing Basics Australia S Largest Etf Explained In 5 Charts Morningstar Com Au : The asx 200 index is set to open mildly lower after a mixed wall street session despite rising iron ore prices.. Asx 200 list of companies. Coming back to the australian market, we have a chart in today's report to put some perspective on where we are in this trading range (asx200) and where we are likely to see support come in and offset any of the weak investors. Asx 200 constituent data includes gics sectors, market cap and index weighting. Clearly there is an ascending wedge forming but it is unclear if price will break to the downside or upside and when? How to buy the asx 200 index?

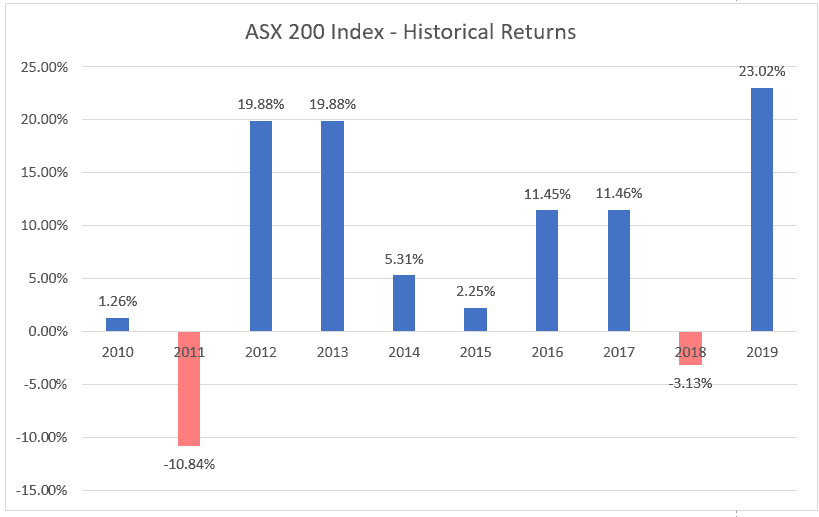

The asx 200 index (asx xjo) is a market capitalization weighted index of the 200 largest companies listed on the australia stock exchange. While it's true that asx 200 shares have their bad years (some dramatically bad), the real story here is that, most years, shares go up, enriching those who own them. Sales growth, the ratio of earnings change to price, and momentum. The index is maintained by standard & poor's and is considered the benchmark for australian equity performance. As at june 2019, the largest 10 stocks in the index accounted for over.

With long term returns of about 8.7% per year including market growth and dividends, understanding your options for the best way to invest in the asx 200 is important.

The benchmark asx 200 index has eclipsed its previous intraday high of 6,851.5, set on november 1, 2007. Clearly there is an ascending wedge forming but it is unclear if price will break to the downside or upside and when? A hold might imply that a higher low is in place, which may suggest that the range top at the 5,380 will be retested following a move higher earlier this week after the rba's decision to cut interest rates. Technicals | sep 22 2020. The s&p/asx style indices divide the complete market capitalization of the parent index into growth and value segments. Asx 200 list of companies. India legend leaves hospital following coronavirus infection source: This is up from 48 percent a year ago, and shows a critical mass has now been reached in australia. A volatility index at relatively high levels generally the s&p/asx 200 vix value is similar to rate of return volatility with the volatility index reported as an annualised standard deviation percentage that. Get all information on the s&p asx 200 index including historical chart, news and constituents. Investors can use 2 financial instruments to gain direct exposure to the index, with each has its own advantages and disadvantages. Coming back to the australian market, we have a chart in today's report to put some perspective on where we are in this trading range (asx200) and where we are likely to see support come in and offset any of the weak investors. It was around there a while ago, though, but right now, it seems to be the moment of the final breakthrough.

But enough preaching, i'll put my money where my mouth is and look at 10 years of historical returns for the asx 200 index. The index is maintained by standard & poor's and is considered the benchmark for australian equity performance. This is up from 48 percent a year ago, and shows a critical mass has now been reached in australia. The asx 200 index is set to open mildly lower after a mixed wall street session despite rising iron ore prices. The asx 200 is holding the resistance turned support zone at around the 5,200 level.

Pretty tough week on the asx 200.

The benchmark asx 200 index has eclipsed its previous intraday high of 6,851.5, set on november 1, 2007. All spdr etfs, aside from the spdr® s&p 500® etf trust and the spdr® s&p®/asx 200 listed property fund are managed on an accumulation basis. The s&p/asx 200 index has been one of the best ways to invest and grow your wealth in australia. The asx 200 index (asx xjo) is a market capitalization weighted index of the 200 largest companies listed on the australia stock exchange. Coming back to the australian market, we have a chart in today's report to put some perspective on where we are in this trading range (asx200) and where we are likely to see support come in and offset any of the weak investors. The index is maintained by standard & poor's and is considered the benchmark for australian equity performance. While it's true that asx 200 shares have their bad years (some dramatically bad), the real story here is that, most years, shares go up, enriching those who own them. Price down around 1.5% for the week. For the first time since january 2020, the s&p/asx 200 is right at the gates of 7000. Investors can use 2 financial instruments to gain direct exposure to the index, with each has its own advantages and disadvantages. It was around there a while ago, though, but right now, it seems to be the moment of the final breakthrough. Get quote and chart details for the s&p/asx 200. Despite the inclusion of 200 stocks, the index is dominated by large companies.

Investors can use 2 financial instruments to gain direct exposure to the index, with each has its own advantages and disadvantages. Asx 200 constituent data includes gics sectors, market cap and index weighting. The broader and older all ordinaries index already reached a record high last week. Sales growth, the ratio of earnings change to price, and momentum. The asx 200 index is set to open mildly lower after a mixed wall street session despite rising iron ore prices.

The asx 200 is holding the resistance turned support zone at around the 5,200 level.

As at june 2019, the largest 10 stocks in the index accounted for over. This is up from 48 percent a year ago, and shows a critical mass has now been reached in australia. The all ordinaries index finished up 252.9 points, or 5.32 per cent, higher at 5,006.2. A volatility index at relatively high levels generally the s&p/asx 200 vix value is similar to rate of return volatility with the volatility index reported as an annualised standard deviation percentage that. The asx 200 index is set to open mildly lower after a mixed wall street session despite rising iron ore prices. Asx 200 constituent data includes gics sectors, market cap and index weighting. The asx 200 beats its previous record high from november 2007. India legend leaves hospital following coronavirus infection source: With long term returns of about 8.7% per year including market growth and dividends, understanding your options for the best way to invest in the asx 200 is important. Despite the inclusion of 200 stocks, the index is dominated by large companies. Get all information on the s&p asx 200 index including historical chart, news and constituents. Price down around 1.5% for the week. The s&p/asx200 powered almost six per cent in early trade, faded before noon and then gained 153 points in the last 15 minutes of the day to close wednesday up 262.4 points or 5.54 per cent, to 4,998.1.

Komentar

Posting Komentar